There are two main ways to handle gift certificates or gift cards in a dealership. You will need to decide how you wish to provide gift cards to determine which option to follow to set them up, either to give them away, or to sell them.

Set Up to Give Away Gift Cards

Set Up to Give Away Gift Cards

Used when your dealership will give away gift certificates.

Set Up GC Payment Type

- Open the Parts & Service module.

- Select the Edit menu from the upper left of the screen.

- Hover over Modify to expand the submenu.

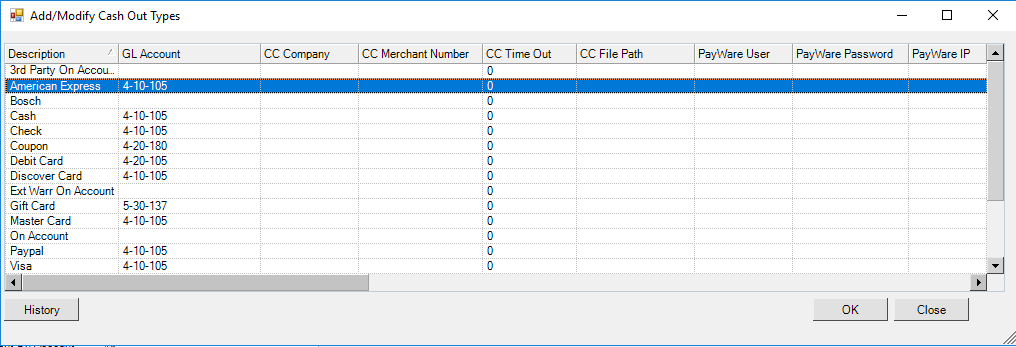

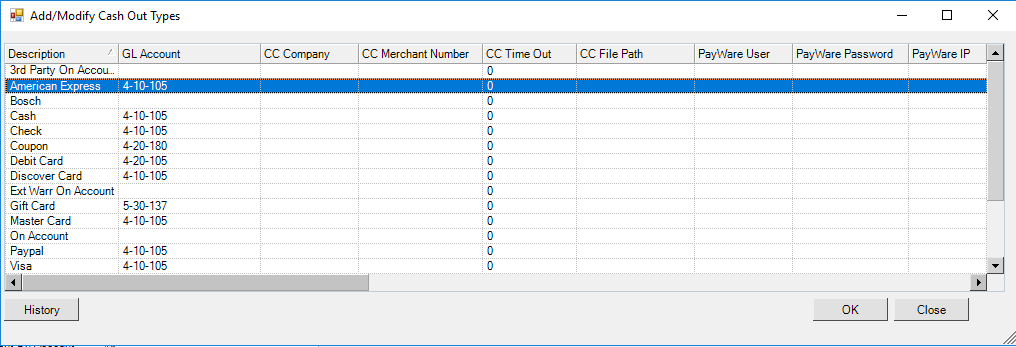

- Choose the Add / Modify Pay Types option. This will open the cash out types window.

- To add a new payment type, contact our support team.

- Enter the GL Account for the Gift Card payment type. This may be either an expense or liability account type.

| IMPORTANT: Consult with your CPA to establish which GL account type your dealership should use for the gift card payment type. This may be an expense or liability account. |

Set Up To Sell Gift Cards

If your dealership will sell gift cards to customers.

Create GC Category

- Open the Parts & Service module.

- Select the Edit menu from the upper left of the screen.

- Hover over Modify to expand the submenu.

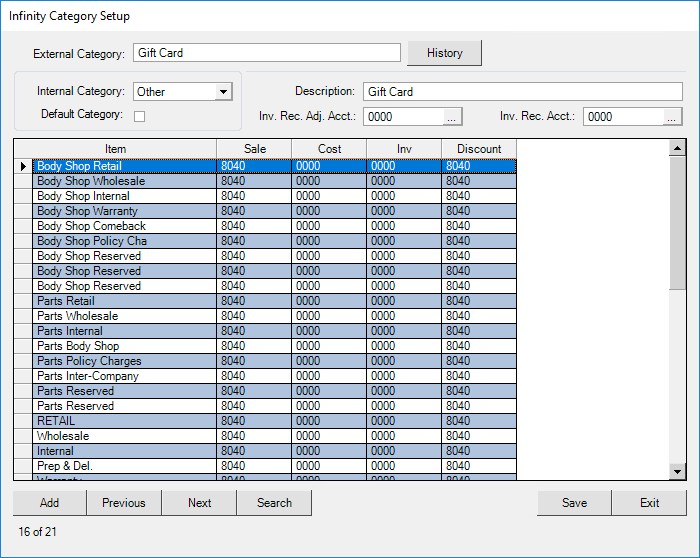

- Choose the Parts / Service Categories option. This will open the categories window.

- Select the Add button in the lower left of the window.

- Enter Gift Card or Gift Certificate as the External Category name. This name is used in reporting.

- Enter Gift Card or Gift Certificate as the description.

- Choose the Internal Category of Other. This is used by accounting to ensure that sales go in the correct account.

- Enter the Sale and Discount GL accounts for your gift cards to use.

| IMPORTANT: Consult with your CPA to establish which GL account type your dealership should use as the Sale account. This may be an expense or liability account. |

- Click the Save button in the lower right.

- Choose the Exit button to close the categories window.

Create GC Item

- Open the Parts & Service module.

- Select (600) Master Inventory from the menu tree on the left side of the screen. This will open a blank master inventory page.

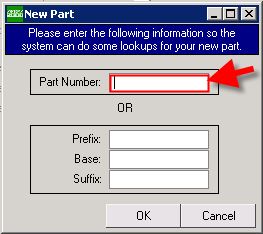

- Select the Add button on bottom left of the page. This will open a New Part popup

- Enter the new part number. This can be alphanumeric or even the words "Gift Card".

- Select the OK button. This will open a new part profile with the part number you entered.

The minimum information needed for the part to be saved includes:

- Default Supplier

- Category

- Part Number

- Description

- Check the box in the lower right that is labeled For Price. This will prompt you for the gift card amount when selling it.

- Select the Save button.

Set Up GC Payment Type

- Open the Parts & Service module.

- Select the Edit menu from the upper left of the screen.

- Hover over Modify to expand the submenu.

- Choose the Add / Modify Pay Types option. This will open the cash out types window.

- To add a new payment type, contact our support team.

- Enter the GL Account for the Gift Card payment type. This should be the same as the Sale Account entered in the Gift Card Category.

Sell Gift Cards

Gift cards can be added to parts or service invoices. Selling the gift card will credit the liability or expense account.

| IMPORTANT: Consult with your CPA to establish which GL account type your dealership should use for the gift card payment type. This may be an expense or liability account. |

- Open the Parts & Service module.

- Select the (102) New Invoice option from the menu tree on the left side of the window. This will open a new, blank parts invoice.

- Search for the customer in the Entity Information section at the top of the invoice. You can search by different criteria like last name, phone number, or unit. If this is a new customer, click the Add/Modify Entity button to enter their information. If this will be used on a unit owned by the dealership, click the Apply Internal button.

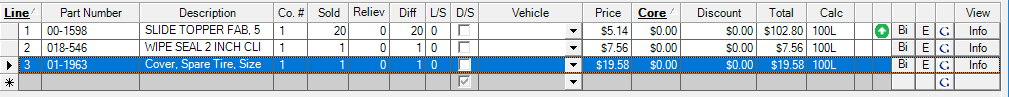

- Add the gift card "part" to the table. You may enter the part number by typing into the Part Number field. If you are unsure of the part number, you can search for parts by using the Search Parts button at the bottom on the invoice.

- You will receive a price popup window. Enter the gift card amount into the window and click OK.

- Enter the quantity sold.

- Enter the quantity relieved.

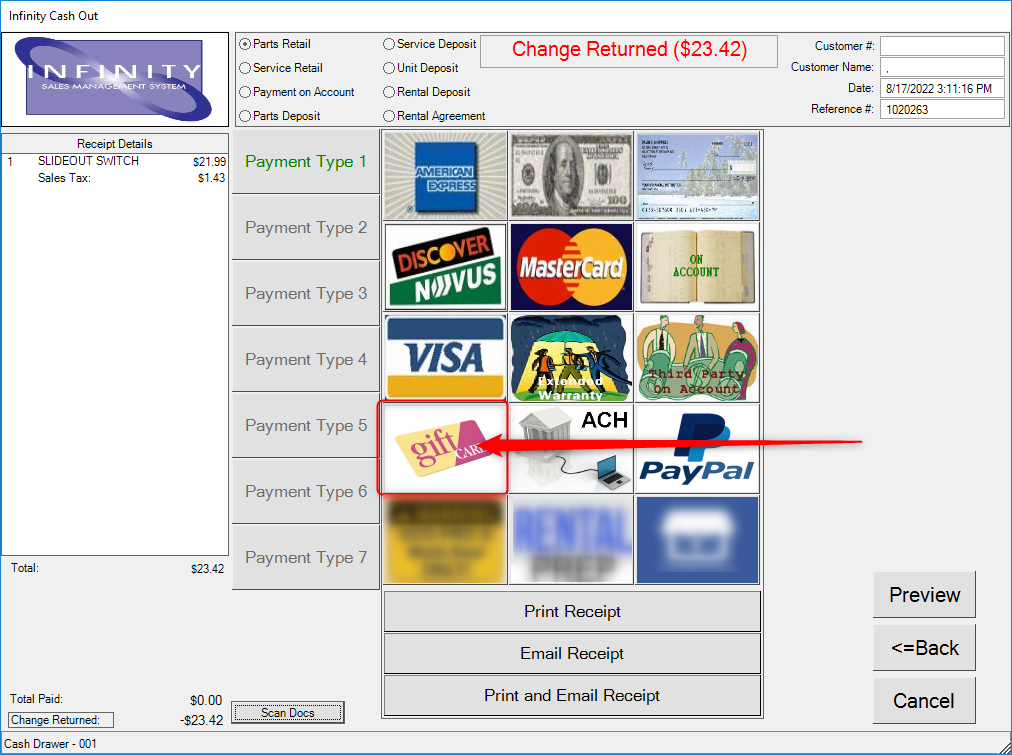

- Click the Cash Out button in the lower left. This will move you to the sales register screen.

- Choose the customer's payment method by clicking over the relevant payment type.

- Complete the transaction by choosing to print the receipt, email the receipt, or both.

Redeem Gift Cards

While selling the gift card will credit the liability or expense account, redeeming the gift card will debit the account.

| IMPORTANT: Consult with your CPA to establish which GL account type your dealership should use for the gift card payment type. This may be an expense or liability account. |

- Open the parts or service invoice for the customer purchase.

- Click the Cash Out button in the lower left. This will move you to the sales register screen.

- Choose the gift card payment method by clicking over the payment type button.

- Enter the amount redeemed from the gift card.

- If there will be another payment type used, select Payment Type 2 tab.

- Choose the payment method.

- Enter the payment amount.

- Complete the transaction by choosing to print the receipt, email the receipt, or both.