Alternative taxes for parts and service invoices can be created, allowing you to collect different tax amounts based on other locations.

Add an Alternative Tax

- Open the Parts & Service module.

- Select the Edit menu from the upper left of the screen.

- Hover over Modify to expand the submenu.

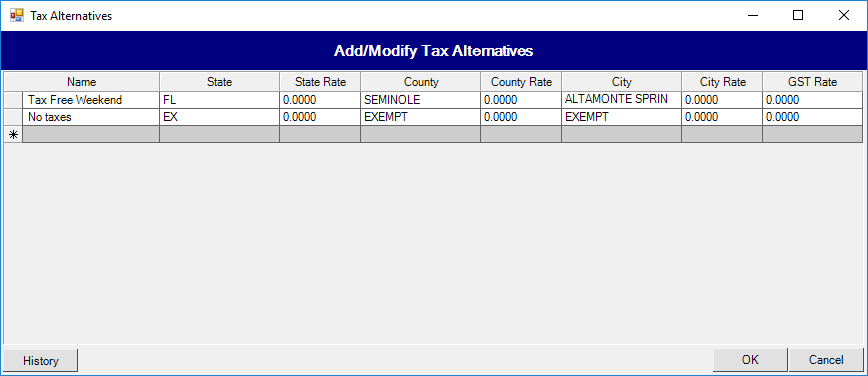

- Choose the Add / Modify Tax Alternatives option. This will open the tax alternatives window.

- Click in the gray row to enter a name for the alternative tax.

- Choose the state where the rate will apply.

- Enter the state tax percentage rate.

- Select the county for the alternative rate.

- Enter the county tax percentage rate.

- Choose the city for the alternative rate.

- Enter the city tax percentage rate.

- If your dealership is in Canada, enter the GST percentage rate.

Use an Alternative Tax

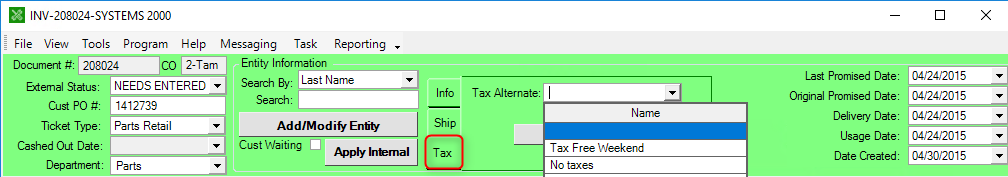

- Open a part or service invoice.

- In the same area at the top of the invoice where a customer is selected, choose the Tax tab.

- Select the alternative tax for this ticket.