States, counties, and cities are added during the dealership setup process. This will include all of the states, and the counties and cities for the state where the dealership is located.

Open County Tax Settings

Add Custom County Taxes

| IMPORTANT: The Motility support team is unable to enter or modify tax information for you. Please contact your CPA or accounting professional for more information or assistance with your specific tax rates. |

Open County Tax Settings

- Open any module.

- Click over the icon of a person in the upper right of the screen.

- Choose the Settings option from the menu. This will open a screen where you can apply settings at different levels.

- Select the App Settings tab.

- Click the Deal Desking subtab on the left side of the screen.

- Choose the State Tax Settings option. This will expand the section.

Add Custom County Taxes

| IMPORTANT: The Motility support team is unable to enter or modify tax information for you. Please contact your CPA or accounting professional for more information or assistance with your specific tax rates. |

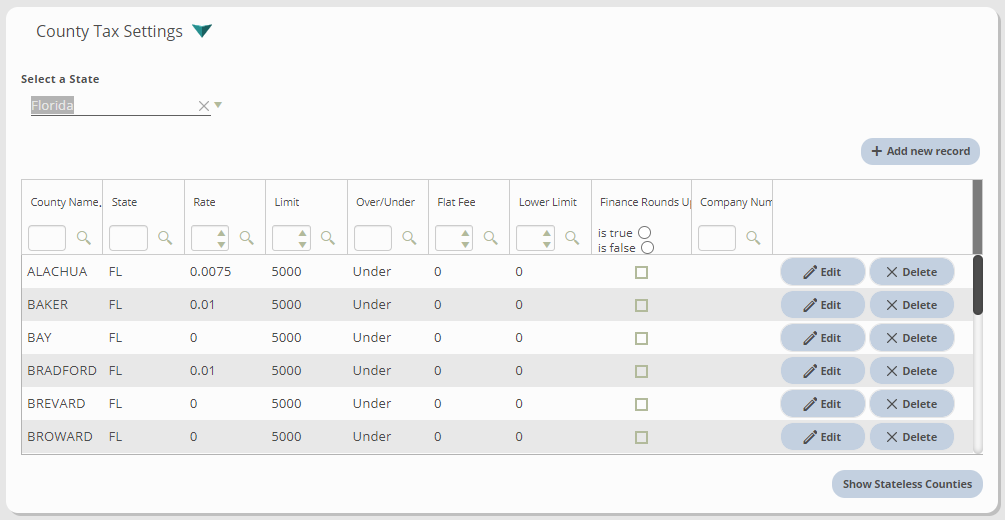

- Click the button to Add New Record. This will add a new, blank line to the table.

- Enter the County Name. This cannot be an exact duplicate of another state.

- Select the State abbreviation. This cannot be an exact duplicate of another state's abbreviation.

- Enter the Tax Rate as a decimal. For example, if the tax rate is 6%, enter this as "6".

- Some states and counties have a cap on their sales tax. For example, if your state charges tax on all amounts over $10,000, you would enter “$10,000” in the Limit field. If there is no cap, leave this field set to 0.

- If you entered a sales tax limit in the Limit field, choose the:

-

- Over option if tax is charged on amounts over that figure.

- Under option if tax is charged on amounts under that figure.

- If a flat dollar amount will be charged, enter the amount into the Flat Fee field.

- If there is a minimum sale amount required to begin calculating taxes on the sale, enter this number into the Lower Limit field.

- Enter the State Code. This cannot be an exact duplicate of another state's code.

- If you want tax calculations to round up to the next dollar, check the Finance Rounds Up box.

- Optionally, you can enter the company number to have these taxes only visible for that specific location.

- Select the Update button on the row.