While these instructions allow you to quickly start setting up the Infinity Accounting software, they may take hours, days, or even weeks to complete, depending on the size of the dealership and your accounting experience. It is very important to get accounting started accurately.

Motility Software recommends that individuals with accounting experience complete these instructions. Although these instructions are intended to be understandable to most users, accounting experience can make the process go more smoothly. Regardless of accounting experience, it can be time-consuming and expensive to fix mistakes later. If you find any of these instructions to be vague or confusing, please contact Motility Software’s Professional Services/Training department.

Enter Starting Balances for Your GL Accounts

Break the Bulk Account Starting Entries Down per Supplier, Customer, etc.

Finishing Up and Checking Your Work for Accuracy

Obtain Your Current Data

- Obtain a Balance Sheet, Trial Balance, and Profit & Loss Statement as of your start date.

- Obtain a detailed list of all vehicles in stock, and inventory and floorplan balances.

- Obtain a detailed list of all customers and their AR balances.

- Obtain a detailed list of all suppliers and their AP balances.

- Obtain a detailed list of all outstanding warranty receivables.

- Obtain a detailed list of all outstanding checks and deposits.

- Obtain a detailed list of all other scheduled accounts and their Customers'/Suppliers' balances.

Enter Starting Balances for Your GL Accounts

- Click Accounting System to get to the Infinity Accounting menu.

- Click General Journal (Journal Z1) to access the General Journal input screen.

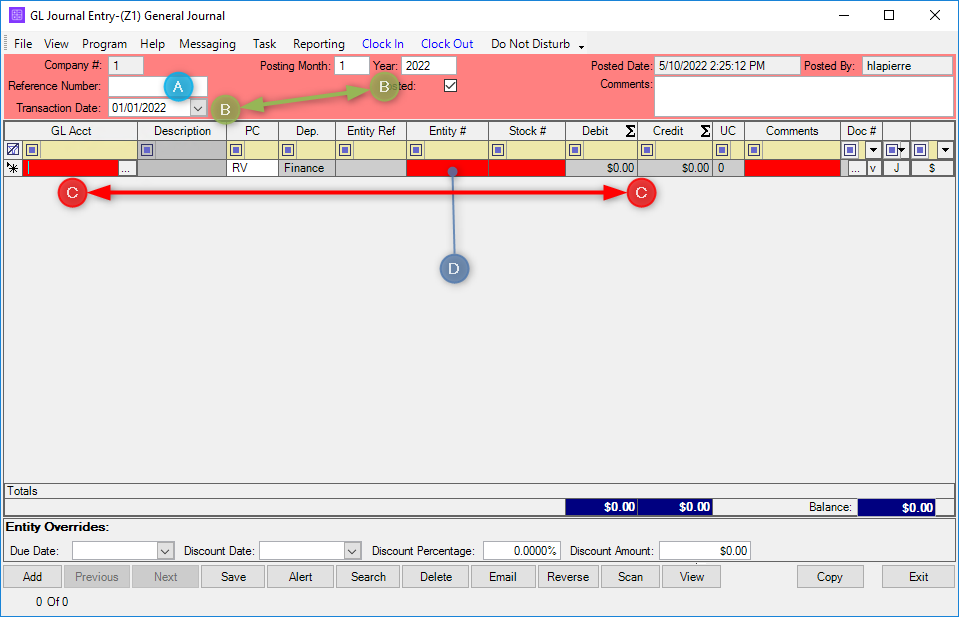

- When the General Journal input screen appears, enter the current General Ledger data.

- Click the Add button in the lower left to open a new, blank transaction.

Here’s how to enter the starting balances for the accounts:

- The reference number (A) should be START-GL. This makes it easier to search for the starting entries later, because you can search for entries that contain the word “start”.

- The date (B) should be a date within the posting month and year that was selected in step 11.

- Line by line, specify each account number and its debit or credit amount (C). Naturally, when entering all the existing values of your accounts, the debits must match the credits.

- In Infinity, entity numbers are stock, customer, or supplier numbers. When asked for a Entity number, enter a dummy Entity 9999 (D).

- Click “Add” to save the entry.

Break the Bulk Account Starting Entries Down per Supplier, Customer, etc.

- Enter another transaction for each vehicle inventory account. Accounts with a type of NV or UV are your vehicle inventory accounts. (NV = new vehicle account type, UV = used vehicle account type). These transactions will have reference numbers called START-NV, START-UV, START-NV2, etc. This transaction will credit the vehicle inventory account for the total amount you entered in step 9 and 10 with stock number 999, and debit the same vehicle inventory account, distributing the total amount to the correct stock numbers (stock numbers go in the Stock # number column). Here is an example:

- Suppose you have a new vehicle inventory of $10,000. That value was entered in step 23 as a debit for $10,000 to a NV account. Let’s say it was account 1230, and you used stock number (stock number) 999. In reality, this new inventory value represents 4 vehicles. We need to split the value among the vehicles. So, the first step is to reverse the bulk entry of $10,000. We would specify a reference number such as START-NV. We credit account 1230 for $10,000, and specify stock number 999 on the first line of the transaction.

- Now we enter the value of the first vehicle. Let’s say it has a stock number of 444, and is worth $1,000. So we debit the inventory account 1230 for $1,000, and specify a stock number of 444 on the next line.

- Next we enter the second vehicle. It’s worth $2,000 and is stock number 555. Debit inventory account 1230 for $2,000, stock number 555.

- Same again for the third vehicle, debit account 1230 for $3,000, stock number 66.

- Finally, the fourth vehicle, debit account 1230 for $4,000, stock number 777.

Click Next or Add to save the transaction and start a new one. (Note: that clicking “Exit” would also save the transaction but return you to the previous menu.)

- Repeat the same process to break out the values of other scheduled, or controlled, accounts. Next create another transaction for each vehicle floorplan account (NF, UF) called START-NF, START-UF, etc. This transaction will debit each vehicle floorplan account for the starting balance amount specified in step 9 and 10, with the stock number 999, and credit the same vehicle floorplan account, distributing the total amount to the correct stock numbers.

Note: You should have a different GL account for each floorplan company.

- Click “Add” to enter another transaction for each accounts receivable account (AR) called START-AR1, START-AR2, etc. This transaction will credit the accounts receivable account for the total amount with the Entity 999 and debit the same accounts receivable account, distributing the total amount to the correct customers. If you would like to enter the detail by invoice number, enter the amounts for each invoice and enter the invoice number in the Entity reference field. Here is an example:

- Suppose the AR account number is 1294, with a total debit amount of $1,000. The starting balance would have been entered in step 9 and 10 as a $1,000 debit with a Entity number (customer number) of 999. Suppose this $1,000 total represented money owed to you by two different customers. To break this down per customer and per invoice, we’ll first need to reverse that bulk entry. We could use a reference number of START-AR1 with a credit to account 1294 for $1,000, Entity number 999.

- If customer number ABC owes $500, $200 of which is billed them on invoice 123 and $300 that was billed on invoice 135, then enter two debit lines. The first would be to account 1294, debit amount $200, Entity number ABC, Entity reference number 123. The next line would be the same but with a debit of $300 and a Entity reference of 135.

Note: If you did not want to track invoice numbers for supplier ABC, but instead wanted to simply enter that they owed you $500 overall, then step B above would have been a single debit line. Specifically, it would be a debit to account 1294 for $500, Entity number ABC. You would not need to specify a Entity reference number to designate the invoice.

- Click “Add” to enter another transaction for each accounts payable account (AP) called START-AP1, START-AP2, etc. This transaction will debit the accounts payable account for the total amount with the Entity 999 and credit the same accounts payable account, distributing the total amount to the correct suppliers. If you would like to enter the detail by invoice number, enter the amounts for each invoice and enter the invoice number in the Entity reference field.

- Click “Add” to enter another transaction for your warranty receivable account (WR) called START-WR. This transaction will credit the warranty receivable account for the total amount with the Entity 999 and debit the same warranty receivable account, distributing the total amount to the correct warranty company’s customer number. If you would like to enter the detail by claim number, enter the amounts for each claim and enter the claim number in the Entity reference field.

- Click “Add” to enter another transaction for each checking account (CK) called START-CK1, START-CK2, etc. This transaction will debit the checking account for the total outstanding amount with the Entity reference OUT and credit the same checking account, distributing the total amount to the correct check using the Entity reference field for your check numbers and deposits. For example:

You will create one entry for each cash account that has outstanding items.

Excerpt from Start-GL

| Account | Acct Description | Debit | Credit | Entity Reference |

| 1202 | Cash Account | $42,000.00 | ||

| Start-Ck1 | ||||

| 1202 | Cash Account | $20,000.00 | OUT | |

| 1202 | Cash Account | $5,000 | 1224 check number | |

| 1202 | Cash Account | $4,000 | 1228 check number | |

| 1202 | Cash Account | $1,000 | 1337 check number | |

| 1202 | Cash Account | $1,000 | 1481 check number | |

| 1202 | Cash Account | $9,000 | 1623 check number | |

| 1202 | Cash Account | $8,000 | 1846 check number | |

| 1202 | Cash Account | $8,000 | 12312003 deposit refr | |

| Total | $28,000 | $28,000 | ||

When you have finished inputting the journal entries outlined in this section, you may click “Exit” to return to the General Ledger Posting Journals menu.

- Click “Add” to enter another transaction for each checking account (CK) called START-CK1, START-CK2, etc. This transaction will debit the checking account for the total outstanding amount with the Entity reference OUT and credit the same checking account, distributing the total amount to the correct check using the Entity reference field for your check numbers and deposits. When you have finished inputting the journal entries outlined in this section, you may click Exit to return to the General Ledger Posting Journals menu.

Finishing Up and Checking Your Work for Accuracy

Your postings will have been updated with the new information. Other background tasks are performed at this time, such as data integrity checking that may alert you to entries that were posted incorrectly.

- Click “Exit” to return to the Infinity Accounting menu.

- You will now mark the starting entries for your checking account(s) as cleared in your check register. Click “Add/Modify Check Register”. This screen will show you a list of outstanding checks. You can scroll through your checking accounts by clicking the Next and Previous buttons. Check off the START-GL and the OUT items as cleared for each account. Click Exit when you are finished to return to the Infinity Accounting menu. For example:

In Add/Modify Check Register, check the following entries as cleared the bank:

| 1202 | Cash Account | $20,000.00 | OUT |

| 1202 | Cash Account | $42,000.00 | Start-GL |

- Now you will print some reports to verify your starting entries against your starting figures. Click on the “Accounting Report” menu button.

- Click “General Ledger Reports.”

- Click “Profit and Loss Report.”

- Print a Profit and Loss report and verify the information.

- Next, you will print a Balance Sheet report. Click “General Ledger Reports.”

- Click “Balance Sheet Report.”

- Print a Balance Sheet report and verify the information.

- Next, you will print a General Ledger detail report. Click “General Ledger Reports.”

- Click “General Ledger Detail Report.”

- Print a General Ledger Detail Report and verify the information.

- Next, you will print a vehicle inventory report. Click “Vehicle Inventory Reports.”

- Click “Vehicle Inv & Floor Plan Report by Stock #.”

- Print the report and verify the information.

- Next is Accounts Receivable. Click “Accounts Receivable Reports.”

- Click “Transaction by Customer #.”

- Print the AR report and verify the information.

- Next is “Accounts Payable.” Click “Accounts Payable Reports.”

- Click “Transaction by Supplier #.”

- Print the AP report and verify the information.

- Finally, you will print a Warranty Receivable report. Click “Warranty Receivable Reports.”

- Print a “Warranty Transaction Report” and verify the information.

- Click “Exit” to return to the Infinity Accounting menu.

Congratulations! You have completed the Infinity accounting quick start procedures!