Listed below are items that should be done at the End of the Year for Accounting.

- Open the Accounting module.

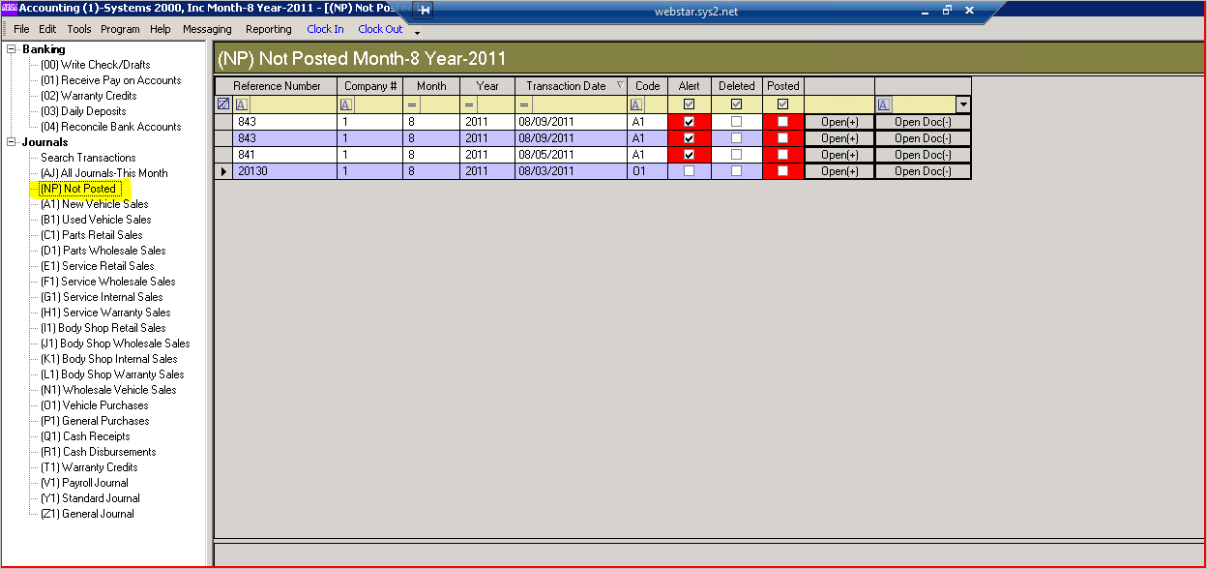

- Review the Not Posted Journal, audit and correct any transactions that may appear in this journal.

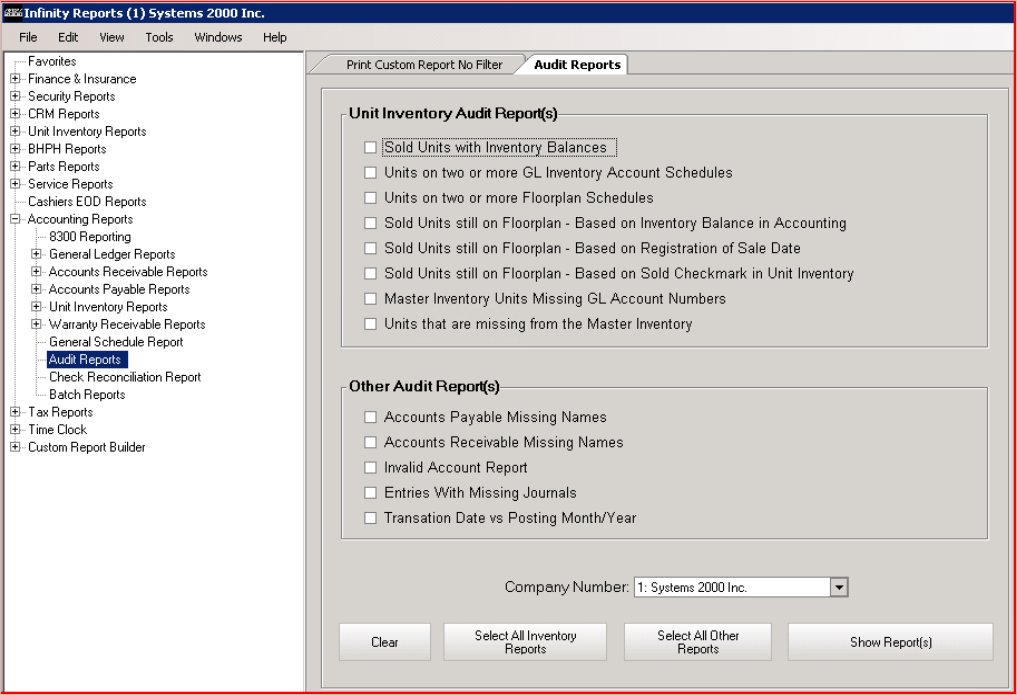

- Print all audit reports; correct any errors that may appear. You may do this by clicking on Reports>Accounting Reports>Audit Reports be sure to run all audit reports.

- Make sure you post all chargebacks to commissions.

- Make sure you make WIP adjustments

-

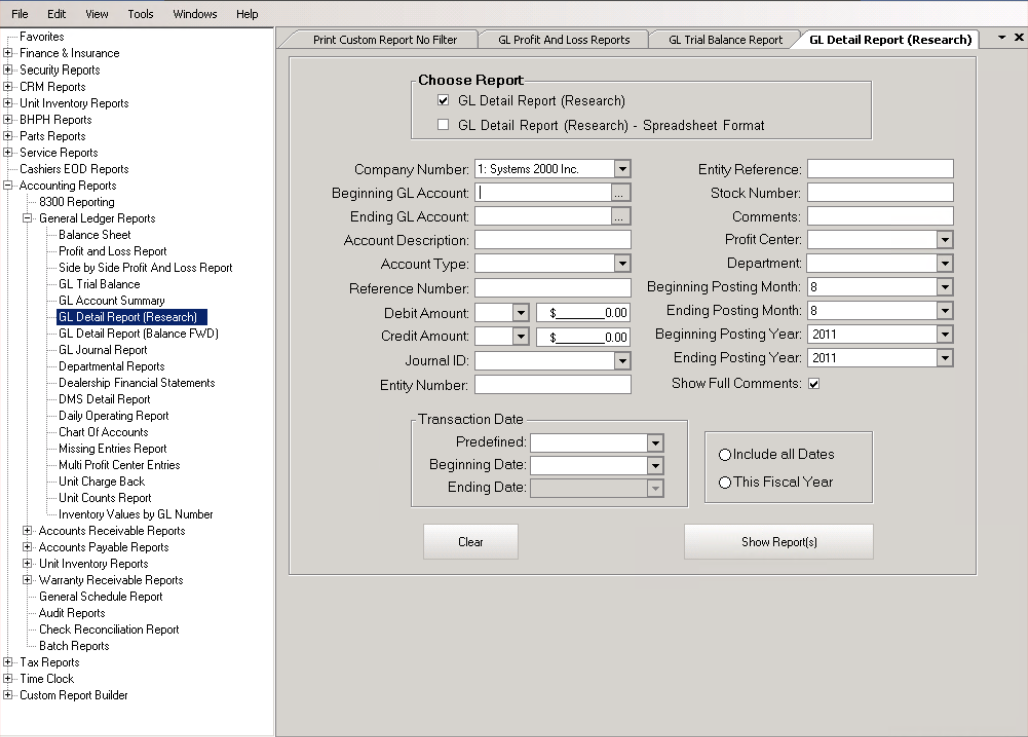

- Run a GL Detail Report (Research) report to get the balance on your unpaid labor account (usually labeled WIP) for the current month and the balance of all mechanic wage expense entries made during this month in payroll.

- Run a GL Detail Report (Research) report to get the balance of all mechanic wage expense entries made during this month in payroll.

-

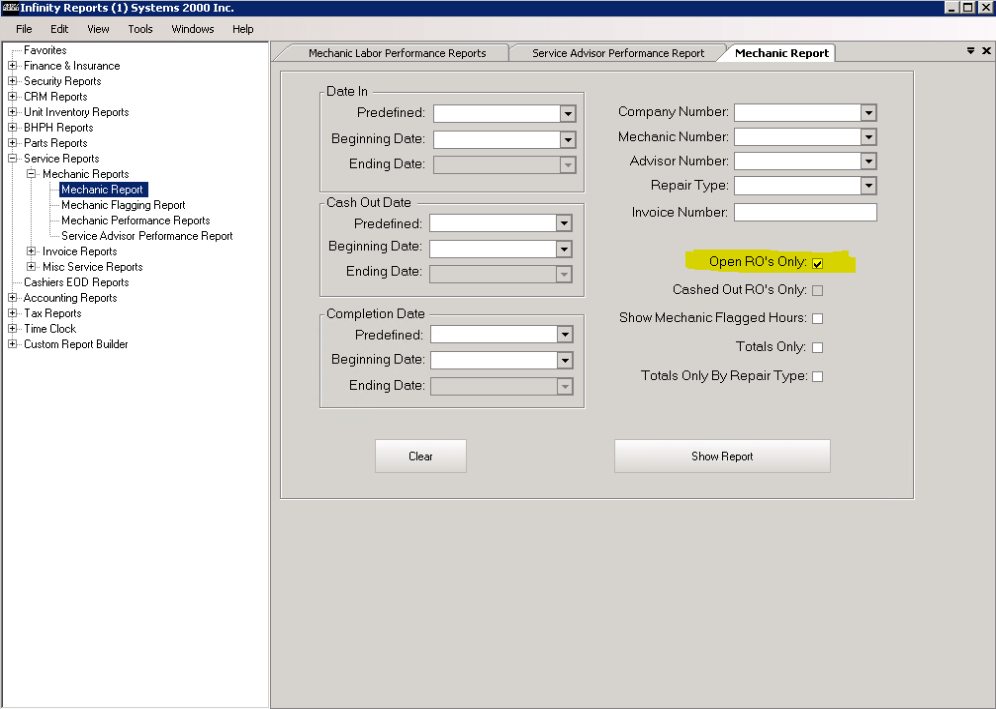

- Run a Mechanic Report filtered for open RO’s only to get the balance for work in process for all non-cashed out tickets open in the current month.

-

- Take the totals generated from the unpaid labor and mechanic reports from above and add them together. Once you have your total for WIP, subtract the wage expense totals. The total will be your WIP entry for the current month. Remember to reverse this entry out the following month.

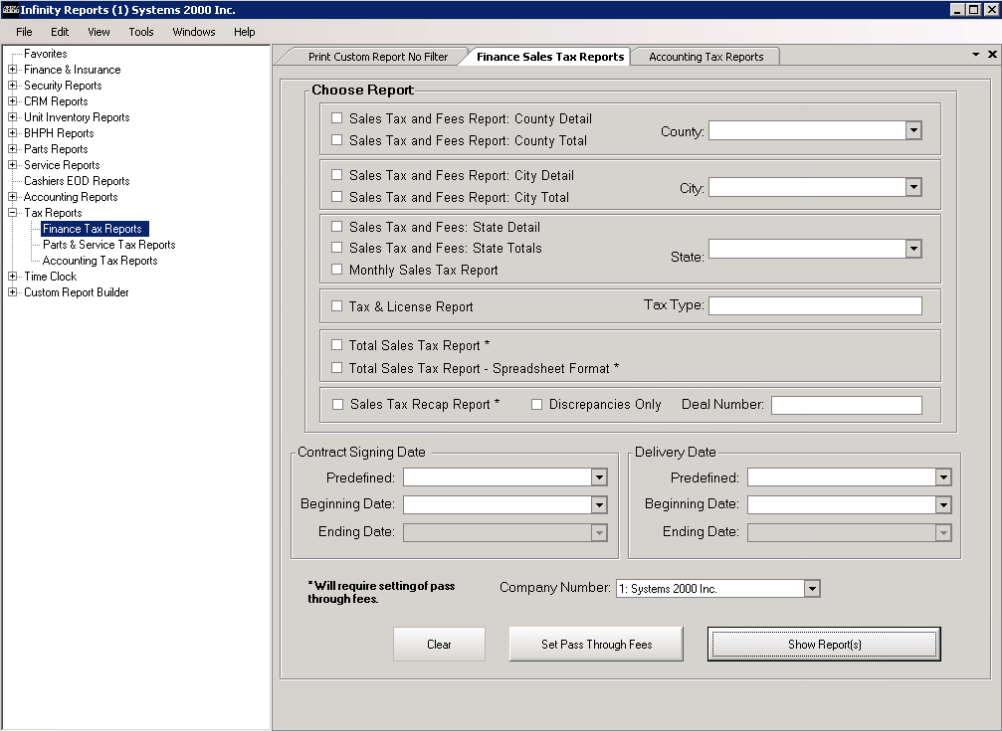

- Print and Reconcile all of your sales tax reports, you can find them under Reports>Tax Reports. Be sure the balances shown in your sales tax LI/AP accounts matches the sales tax report for that tax period. Be sure to print and save your final version of these reports to a .pdf file.

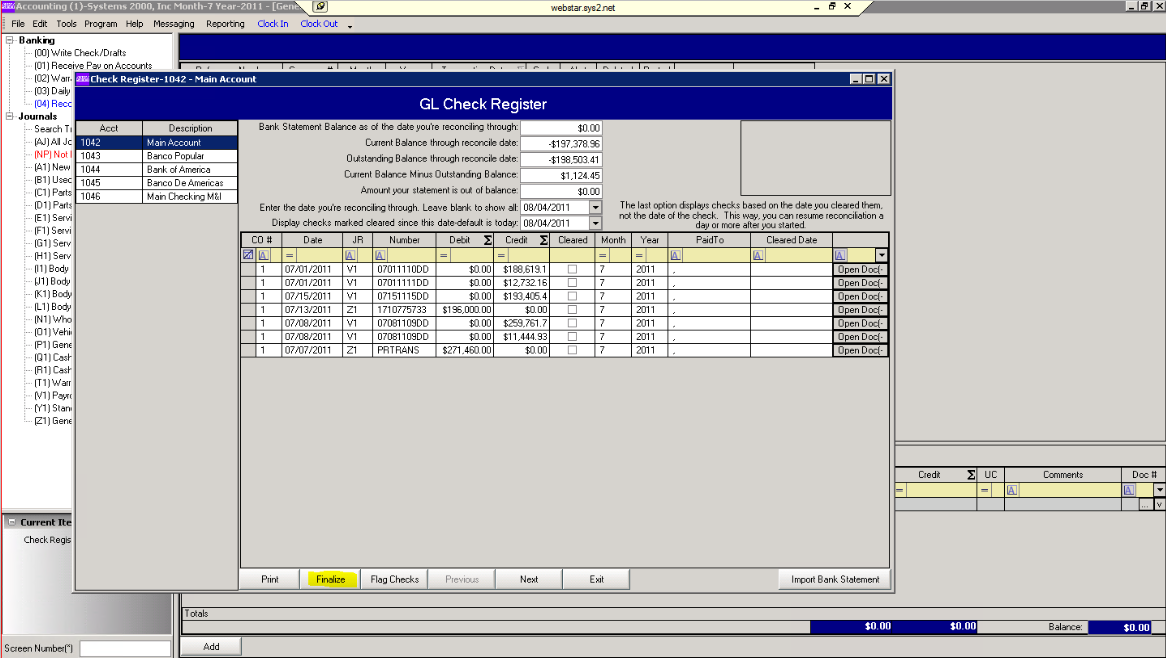

- Reconcile your bank accounts. To do this click on Accounting > (04) Reconcile Bank Accounts and mark all checks that have cleared, etc. Once you have reconciled your check register to your Bank Statement and everything is balanced you will need to finalize it by clicking on “Finalize in the GL Check Register Screen. Print this report and Save it to a .pdf file.

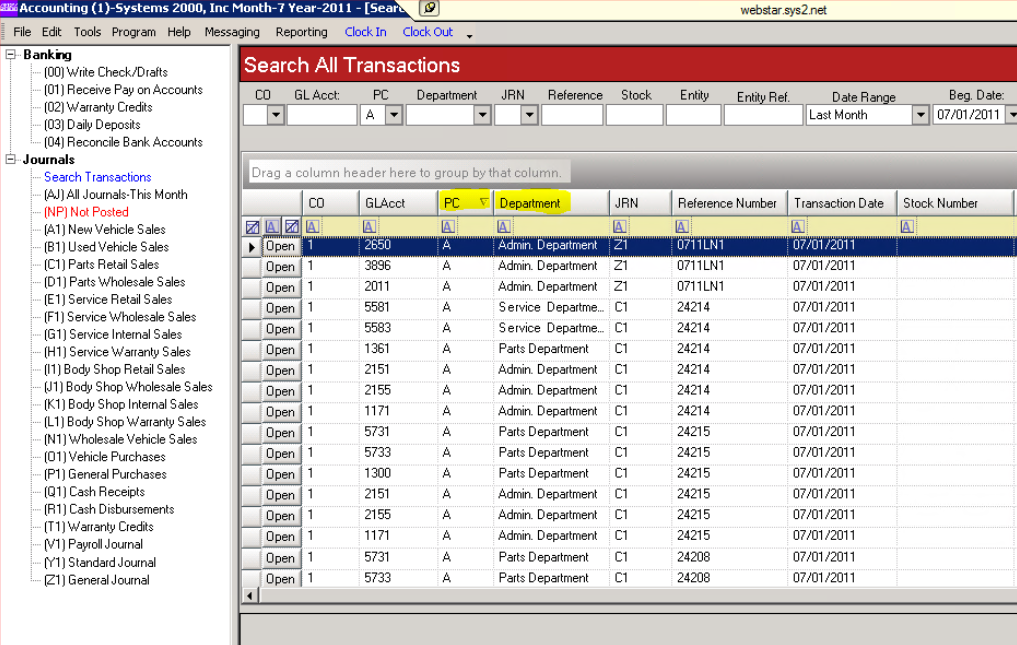

- Verify that all transactions are assigned to a Profit Center; if your dealership is fully departmentalized make sure that all transactions are assigned to a department. You can do this by clicking on Accounting>Search Transactions then in the filter for date range make sure you select the month you intend to close out. Finally, you will want to sort both your PC and Department columns and check for any blanks. If you do find any, make sure you assign the correct Profit Center or Department.

- You want to print your financial statements and review them for accuracy. Click on Reports>Accounting reports and run the following reports.

-

- Profit and Loss Report

- Balance Sheet Report

- GL Trial Balance

- If this is your first time closing the month and you have multiple profit centers you will also want to run the Trial Balance report and filter it by each profit center. Once you’ve printed each profit centers trial balance you will need to add the totals on each profit center up and make sure that they match the totals for the Company as a whole.

- If this is your first time closing the month and you are fully departmentalized you will need to run a Profit and Loss report for each department. Once you’ve printed each departmental report you will need to add the totals up on each departmental statement and make sure it totals out to your company wide Profit and Loss Report. If you have multiple profit centers you will also need to do this by profit center as well.

It is also recommended that you review the following reports and make sure their balances are correct and balance out to your balance sheet.

-

- Accounts Receivable Transactions Report

- Accounts Payable Transactions Report

- Warranty Receivable Transactions Report

Please be sure to print all of the final versions of these reports to .pdf files to keep on hand at the end of the year.

- If your system is set up so that Accounting transactions do NOT update master inventory, we also recommend that you print a Unit Inventory Report from Accounting by going to Reports > Accounting Reports>Unit Inv/FP by Stock # as well as from Reports>Unit Inventory Reports > Unit Inventory Accounting Manager and filter by unsold units. You will then need to compare both reports and make sure they match.

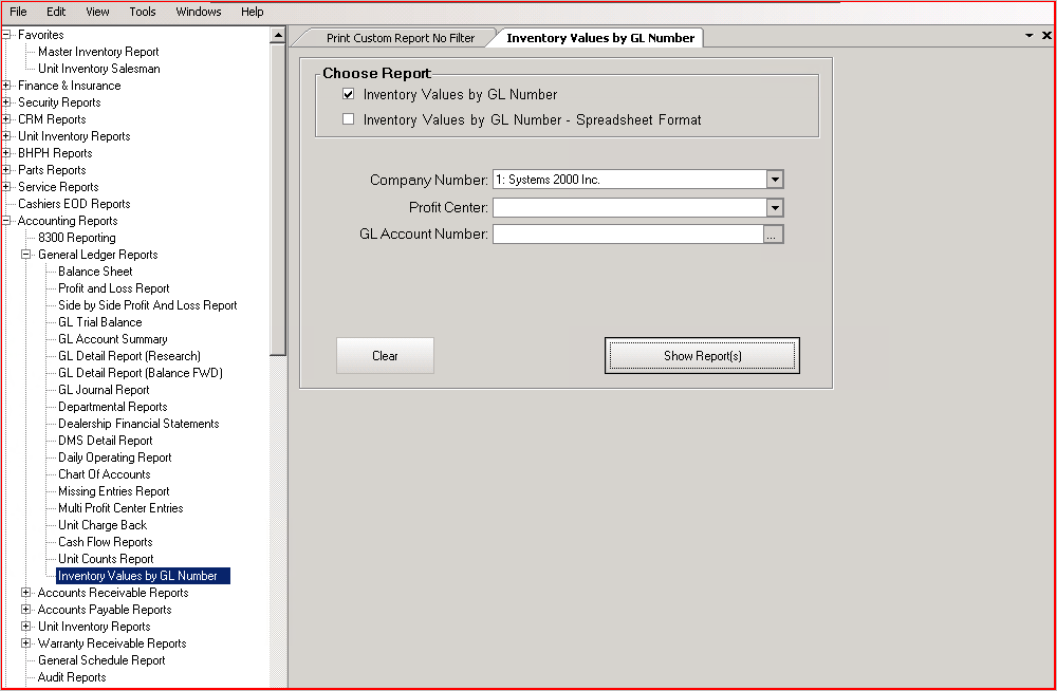

- Make sure you run the Inventory Values by GL Number report in accounting and that you verify your parts inventory balance closely matches your accounting balance. Your variance should not be too far off.

Important Note: This report is time sensitive and recalculates daily. You cannot run this for a past period, only for the current day. Please note that most other inventory reports in parts are time sensitive as well.