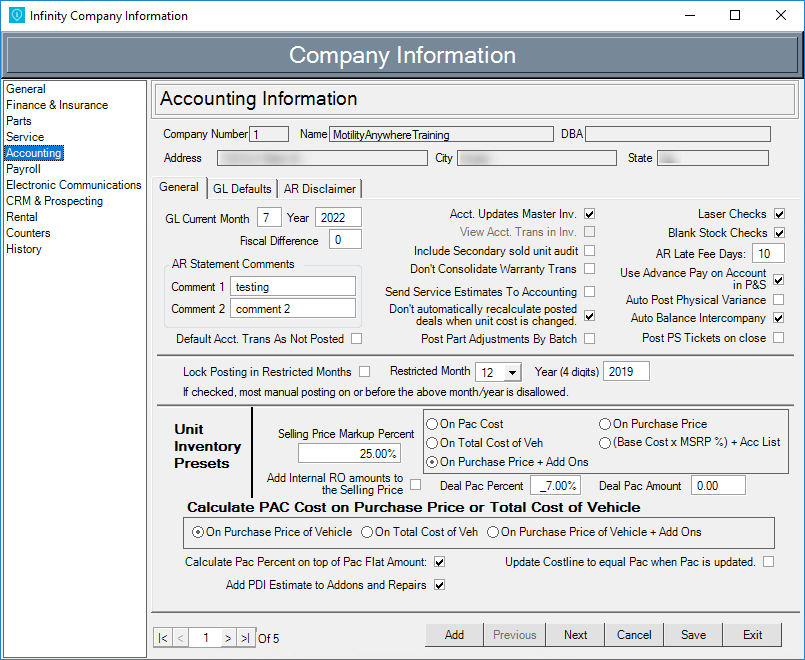

Company Settings control how the program handles different features and options. The Accounting section allows you to set defaults for many different areas of the accounting module.

- Select the Company Information module.

- Click the Accounting menu option on the left side of the screen.

General Tab

GL Current Month

The current month as set in the accounting module will show in this field. Optionally, you can update the current month here.

GL Current Year

The current year as set in the accounting module will show in this field. Optionally, you can update the current year here.

Fiscal Difference

This is only used if your fiscal year is not January through December. Calculate the calendar month, then subtract 1 to equal the fiscal year. For example, if your fiscal year begins in March (3), subtract 1, then enter 2 in this field.

AR Statement Comment 1,AR Statement Comment 2

Enter text here to show at the bottom of AR Statements.

Default Acct Trans as Not Posted

Check this option to not have the Post Transaction box automatically checked when creating manual accounting transactions.

Acct. Updates Master Inv.

Check this box to delete F&I inventory information and repopulate with what is shown in accounting.

| IMPORTANT: Selecting this option will delete information. This information cannot be recovered! |

View Acct. Trans in Inv.

Check this box to view accounting transactions in unit inventory.

Note: This option only works if the Accounting Updates Master Inventory option is not checked.

Include Secondary Sold Unit Audit

The program warns you when when you have sold units that have floorplan amounts owed on them. Units with a zero inventory balance in accounting are considered sold. Check this box to also include units whose sold box is checked.

Don't Consolidate Warranty Trans

(Normally Unchecked) Check this box if your dealership needs warranty claim transactions broken out in detail by job.

Send Service Estimates To Accounting

Check this option to have estimates show in the unit's accounting transactions. If unchecked, estimates will show as a placeholder in the unit's vehicle transactions.

Don't Automatically Recalculate Posted Deals When Unit Cost is Changed

Check this box to not allow unit costs to change in completed deals if those costs change after the deal is done

Post Part Adjustments By Batch

Check this option if you want part adjustments to be posted by manually running the tool in accounting. Leaving this box unchecked will automatically allow part adjustments to post one at a time to accounting.

Laser Checks

Check this box if you will be printing checks on a laser printer. Uncheck this box to use a dot matrix printer.

Blank Stock Checks

Check this option if you will print checks on blank stock.

AR Late Fee Days

Enter the number of days before late fees are processed. For example, if you enter 30, late fees will begin processing on day 31.

Use Advance Pay on Account in P&S

Check this box to have on-account transactions automatically apply to the customer. These transactions, credit limits, etc. will display on the customer's AR info tab. Uncheck this box to show a popup when cashing out an on-account payment, requiring selecting the entity and GL account.

Auto Post Physical Variance

Check this option to have the program create the variance transaction when a physical inventory count is posted.

Auto Balance Intercompany

(Multilocation) Check this box to have the program automatically create transactions to balance transactions between companies.

Post PS Tickets on Close

Check this option to have parts and service invoices post to accounting when they have been closed.

Lock Posting in Restricted Months - If Lock Posting in Restricted Months is checked, most manual posting on or before the below restricted month and year is disallowed.

Check this box to disallow manual posting on the month and year you specify below. All previous months will also be restricted even if the month is open. This does not affect Y1, Z1, or automatic transactions.

Restricted Month

Enter the month that you want to restrict.

Restricted Year (4 digits)

Enter the year that you want to restrict.

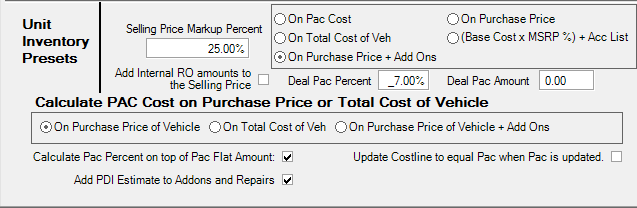

Unit Inventory Presets

Selling Price Markup Percent

If you wish to update the unit selling price by a default percentage, enter the percentage here. You can define what the percentage markup is calculated on, in the Price Markup Method box to the right.

Price Mark Up Method

Select how you want the markup percentage applied to units. Options include:

- On PAC Cost

- On Total Cost of Vehicle

- On Purchase Price + Add-Ons

- On Purchase Price

- (Base Cost x MSRP %) + Accessory List

Add Internal RO Amounts to the Selling Price

Check this option to add cashed out RO totals to the selling price of the unit.

Deal Pac Percent

Enter the default PAC percentage for your dealership in this field. If your dealership does not apply a default PAC percentage, leave at 0.

Deal Pac Amount

Enter the default PAC dollar amount for your dealership in this field. If your dealership does not apply a default PAC amount, leave at 0. This option may be used in addition to or instead of the setting above. You will need to check the Calculate Pac Percent on Top of Pac Flat Amount box below.

Calculate PAC Cost on Purchase Price or Total Cost of Vehicle

If your dealership will calculate a PAC percentage, select the option to calculate based on. Options include:

- On Purchase Price of Vehicle

- On Total Cost of Vehicle

- On Purchase Price + Add-Ons

Calculate Pac Percent on Top of Pac Flat Amount

If you wish to charge both the PAC percentage and the PAC dollar amount on units, check this box.

Update Cost Line to Equal Pac When Pac in Updated

Check this option to update the unit cost line field when PAC amounts/percentages are changed.

Add PDI Estimate to Addons and Repairs

Check this box to have the PDI estimate amount added to the unit's add-ons and repairs field. The estimate will increase the unit cost until the PDI repair order is completed. Once the RO is closed and the PDI Complete box is checked, the total amount will update the estimate amount.

GL Default Accounts

| IMPORTANT: GL accounts are automatically filled into these GL account fields based on our best-practice database. Please be careful if you choose to make changes! Changing these GL accounts can negatively impact how the program works for your dealership. |

|

Service Cash Clearing Acct Parts Cash Clearing Acct Finance Cash Clearing Acct Rental Cash Clearing Acct State Sales Tax - GL Acct Sales Tax Expense - GL Acct County Sales Tax GL - Acct City Sales Tax GL - Acct Warranty Rec Acct Number A/P Discounts Earned GL Acct. Retained Earn GL Adjustment Acct AR Late Fee Sale Acct Default AR Account Type Default AP Account Type Default AP Acct Default AR Acct Unit Inv. Inter-Company Transfer Unit FP Inter-Company Transfer |

1000 1000 1000 1000 2200 (blank) 2210 2210 1140 5200 3410 8830 5210 O O 2100 1100 1390 3390 |

Inter-Company Transfer GST Purchase Acct GL Internal Estimate Floorplan to AP Acct Receiving Tax Acct Receiving Tax Sec. Acct Service WIP Acct Zero Dollar Invoice GL P&S Suspense Acct Drop Ship in Process Receive in Process Standard Cost GL Acct RTD GL Acct MFG Rebates Revenue MFG Rebates AR |

(blank) (blank) (blank) 2140 (blank) (blank) (blank) 8830 (blank) (blank) (blank) (blank) (blank) (blank) (blank) |

AR Disclaimer

(Not Active) Enter disclaimer text that you want to show on AR invoices.