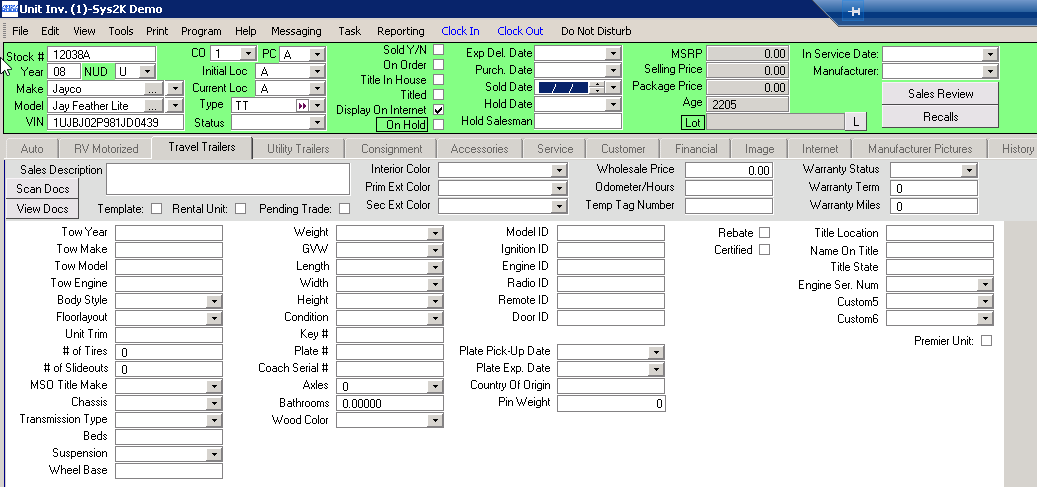

- Create the unit in Unit Inventory. Fill out all header information (Year, Make, Model, etc.) and fill out as much detailed information as possible on the unit tab (RV motorized, Travel Trailers, etc.)

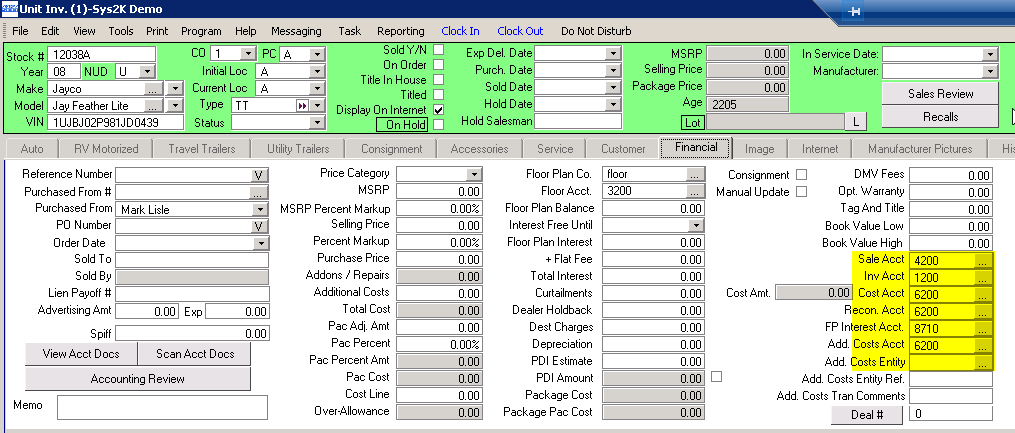

- Go to the ‘Financial’ tab and enter the corresponding Sales, Inv, Cost, Recon, FP Interest, and Add'l Costs GL accounts.

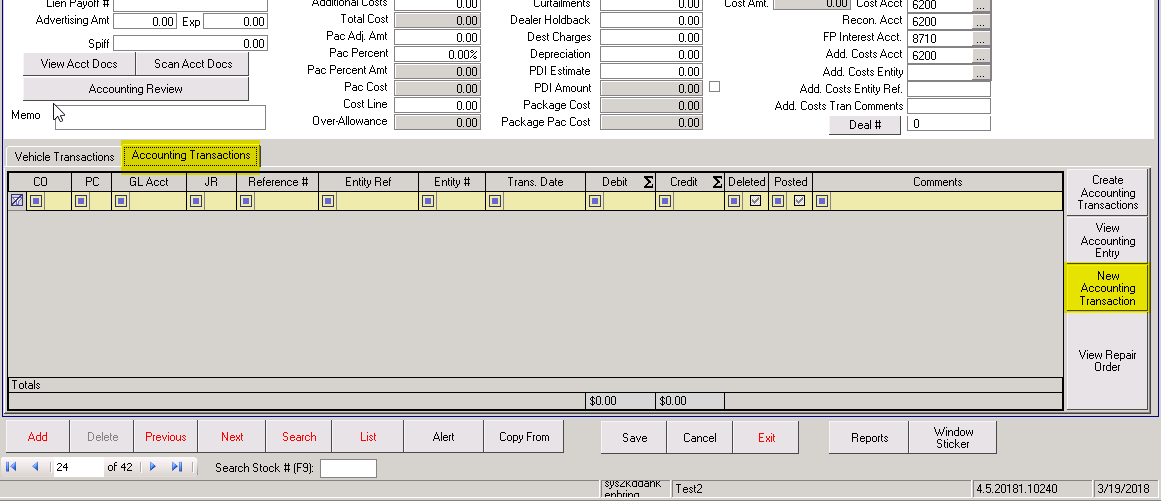

- Select the ‘Accounting Transactions’ sub-tab on the ‘Financial’ tab and press the ‘New Accounting Transaction’ button.

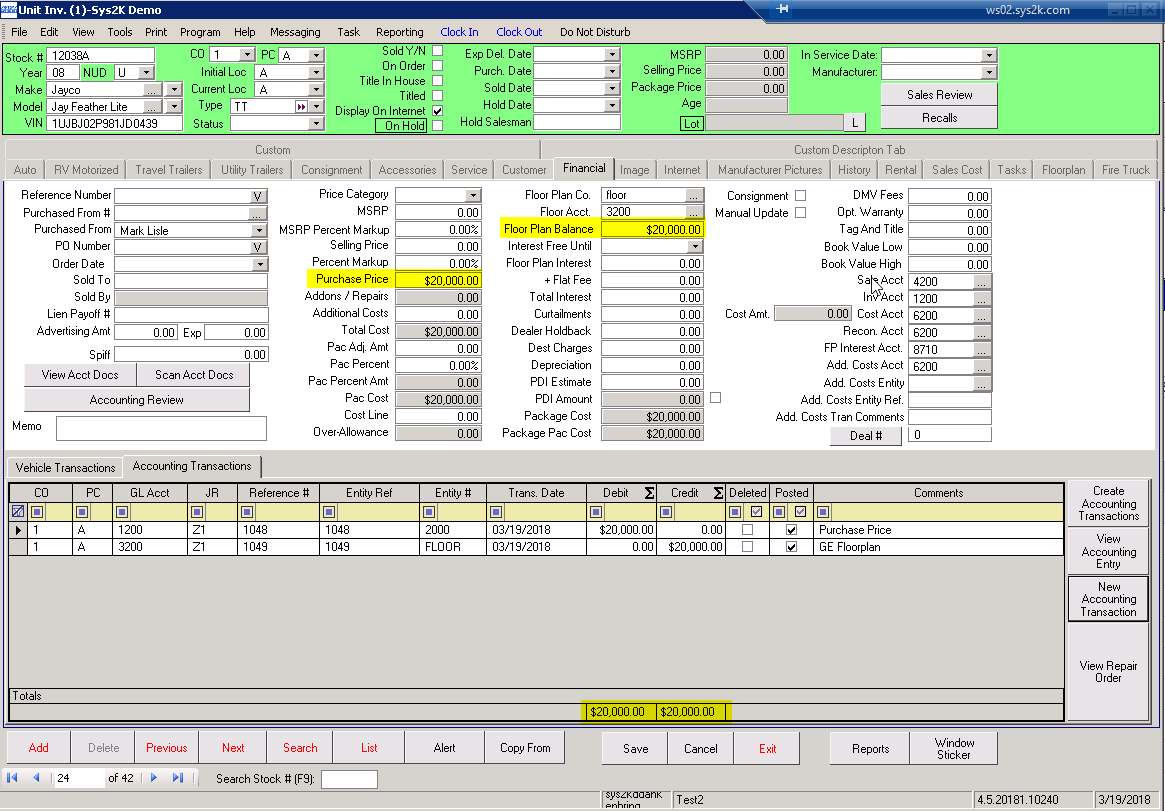

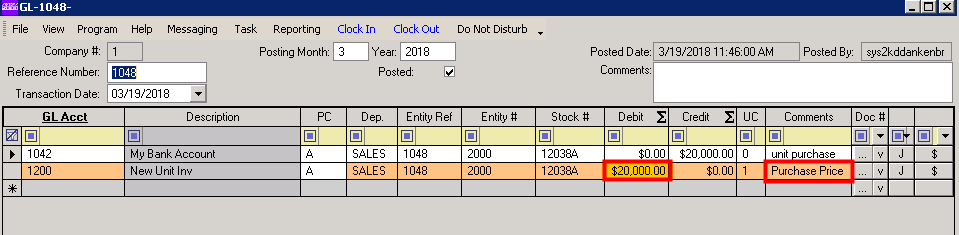

- You will now create the purchase transaction. Add a line and select the bank/checking account you’re using to purchase the unit, enter the purchase amount as a credit. Add another line to the transaction, use the INV GL that you entered on the financial tab, enter the purchase price as an amount (this is the debit to your unit inventory account).

IMPORTANT! In the comments field for the debit line, you will need to enter Purchase Price, this is what forces the purchase amount into the purchase price field on the Financial tab of the Unit Inventory module. Save and exit the transaction.

NOTE: If you ever forget to add the comment ‘Purchase Price’, you can re-open the transaction and add it, when you save it will force the purchase price into the correct field, however you will need to zero out the amount in the ‘Additional Costs’ field.

| If the unit will not be floored, you can now save the unit. Follow steps 5 & 6 if the used unit will be floored. |

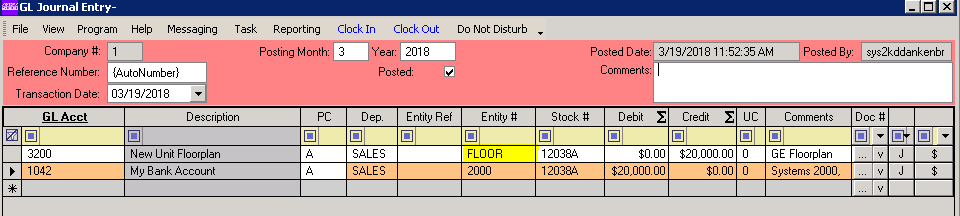

- You will now create the Floor Plan transaction. Press the ‘New Accounting Transaction’ button again. You will select the floorplan GL account you are using, and enter the floor amount in the Credit field. Make sure that you enter the Floor Plan entity# of the floorplan company you are using in the Entity# field. Your next line will be the bank GL account that you want to debit. Save and exit. You’re done!

- At this point, the balance at the bottom of the Accounting Transactions tab should be in balance, and the amounts in the Purchase Price and Floor Plan Balance fields should match with what was entered on your respective entries.